Elysys Wealth – Forwards

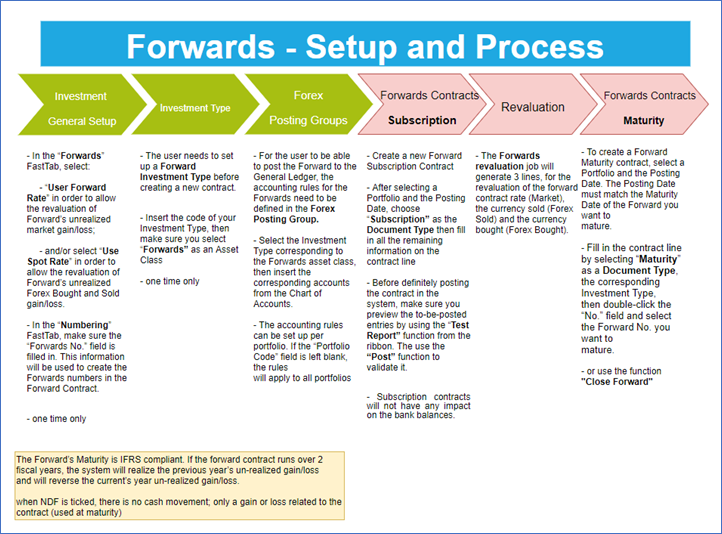

This document describes the standard functionalities of the Forwards module within Elysys Wealth, as well as the required setup.

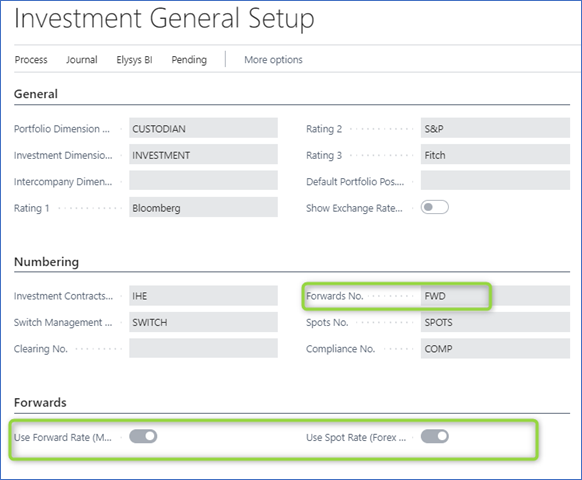

Investment General Setup

The user must make sure the following settings had been set up:

Home Page ➔ Application Setup ➔ Investment General Setup ➔ Button: New or Edit

This page contains the investment module setup. This setup needs to be done at the early stage and before any entries can be made by the module.

-

Portfolio Dimension code: Specifies the code to identify the Portfolio throughout the system.

-

Investment Dimension code: Specifies the code used to identify the Investment throughout the system.

-

Investment Contracts Header Nos: Specifies the number series to number Investment contract headers.

-

Swift Management Header: Specifies the number series used by the Switch Contract function.

-

Transfer Management Header: Specifies the number series used by the Transfer Contract function.

-

Clearing No.: Specifies the clearing account is used by the Switch function. The balance of the investment closed by the function is booked to this account and the value of the investment being opened is also booked from this account.

-

Trade Date Accounting: Specifies if the user needs to run the settlement process to transfer the cash from the settlement account to the bank.

-

Forwards No.: Specifies the number series used in the Forward Contract.

-

User Forward Rate: specifies if the user allows the revaluation of Forward’s unrealized market gain/loss;

-

Use Spot Rate: specifies if the user allows the revaluation of Forward’s unrealized Forex Bought and Sold gain/loss.

Investment Type

Now, we need to define all Investment types that will be used throughout the investment module with their accounting rules. Investment types need to be defined according to how investments need to be grouped and accounted together, it is the equivalent of the product posting group of Business Central. Investment types are required for every Investment product ranging from Equities to Options and Forex products plus Private Equity.

-

Code: Specifies the code to identify the Investment Type.

-

Name: Specifies the name for the Investment type.

-

Asset Class: Specifies the asset class relating to the investment type being created. The Asset Class defines how the investments are managed / handled by Elysys Wealth as each asset class uses its own logic.

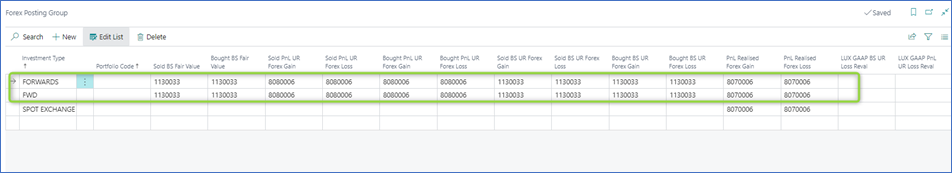

Forex Posting Group

Once all investment types are created, the accounting rules must be specified using Investment posting group.

Accounting rules allows Elysys Wealth to know which account to use in the process of creating all accounting entries when booking investment trades. The Investment posting group page is one of the setup page used by the module along with the coupons posting group, the forex posting group, the options posting group, the dividends posting groups and so on.

For each of the Investment type belonging to those assets class a nominal account is required for the following account:

-

BS at Cost Account: Specifies the General Account used to book cost related entries such as purchase and sales type entries

-

BS UR Forex Gain/Loss Reval: Specifies the Balance Sheet General account used to book unrealised forex gain and loss calculated by the revaluation.

-

BS UR Market Gain/Loss Reval: Specifies the balance Sheet General account used to book unrealised Market gain and loss calculated by the revaluation.

-

PnL UR Market Reval: Specifies the Profit and Loss General account used to book unrealised Market gain and loss calculated by the revaluation.

-

PnL UR Forex G/L Reval: Specifies the Profit and Loss General account used to book unrealised forex gain and loss calculated by the revaluation.

Investment Card

No investment card is needed.

Journals & Posting procedures

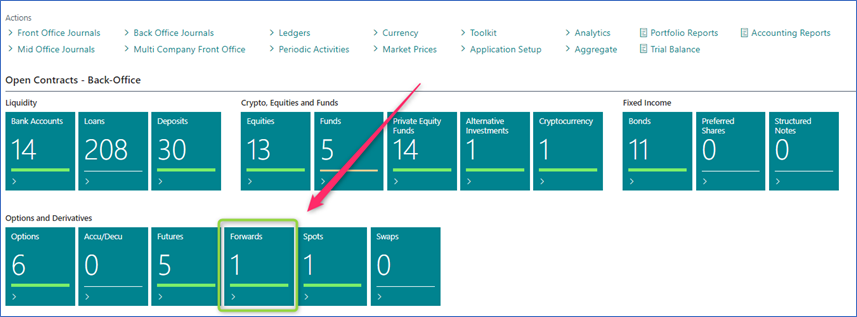

1. Subscription

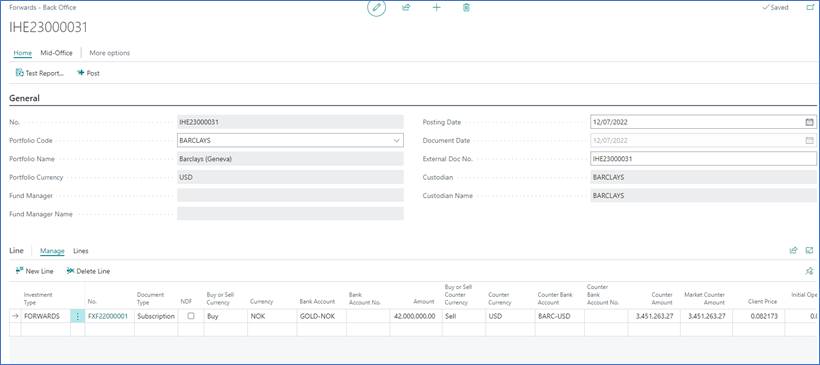

Create a new Forward Subscription Contract.

- After selecting a Portfolio and the Posting Date, choose “Subscription” as the Document Type then fill in all the remaining information on the contract line.

- Before definitely posting the contract in the system, make sure you preview the to-be-posted entries by using the “Test Report” function from the ribbon. The use the “Post” function to validate it.

- Subscription contracts will not have any impact on the bank balances.

Test Preview to check the accounting impact that will be generated after posting. The contract will be posted in the Forex Ledger.

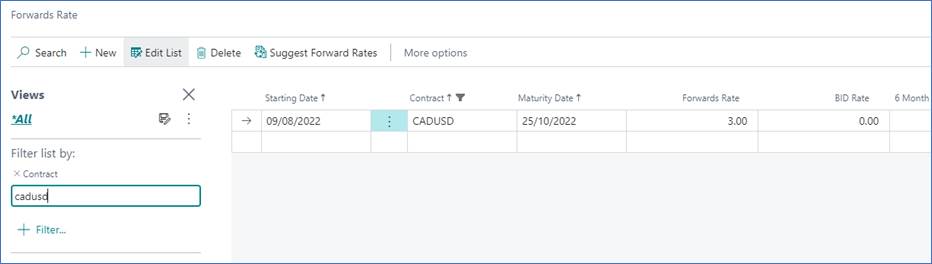

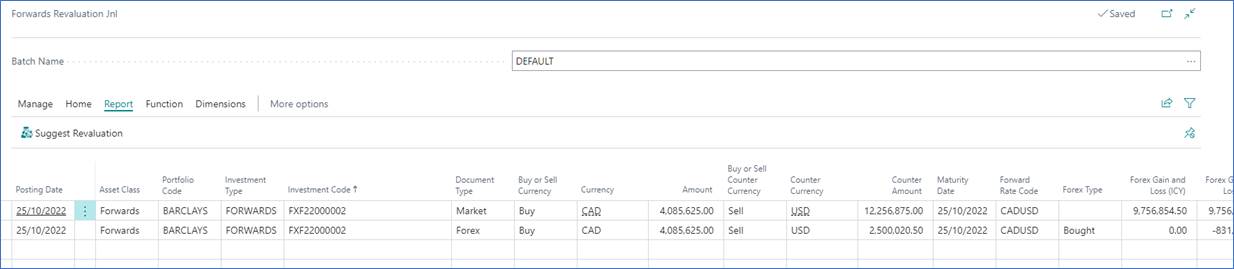

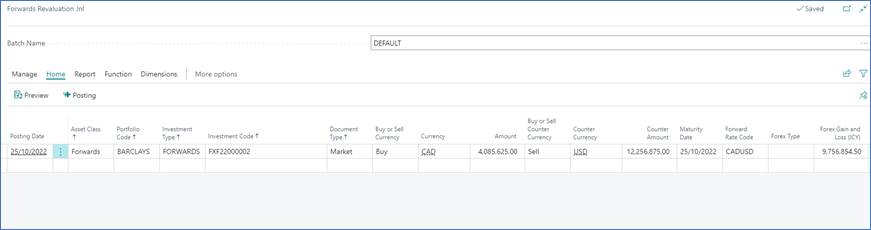

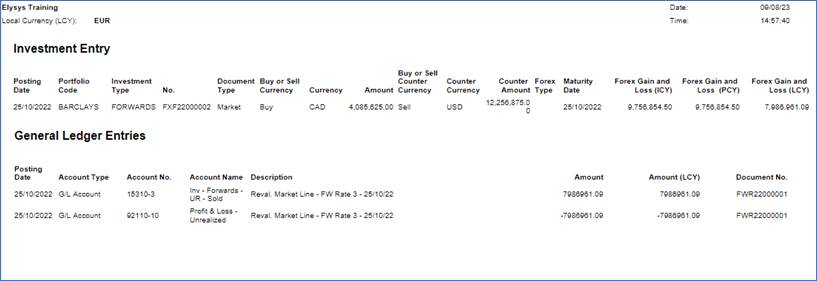

2. Portfolio Revaluation

Go to: Home Periodic Activities Button: Forwards Revaluation

First, fill in the forward rate with the rate + maturity date + relation/ couple.

The Forwards revaluation job will generate 3 lines, for the revaluation of the forward contract rate (Market), the currency sold (Forex Sold) and the currency bought (Forex Bought).

Test Report to see the accounting impact before posting.

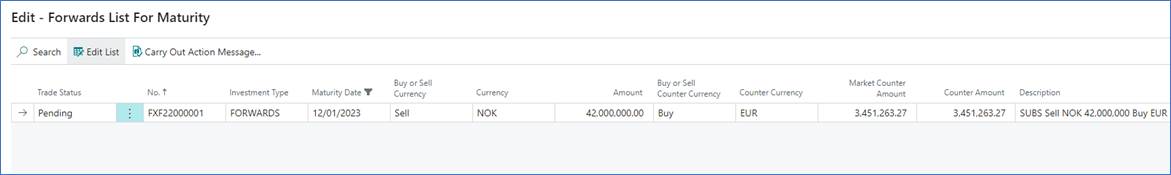

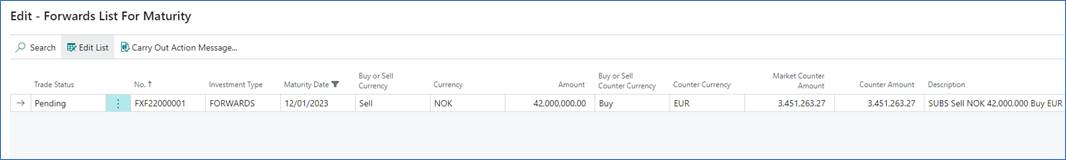

3. Maturity

Go to: Home ➔ Actions: Periodic Activities ➔ Button: Coupon Journal or Structured Notes Coupon Journal

To create a Forward Maturity contract, select a Portfolio and the Posting Date. The Posting Date must match the Maturity Date of the Forward you want to mature.

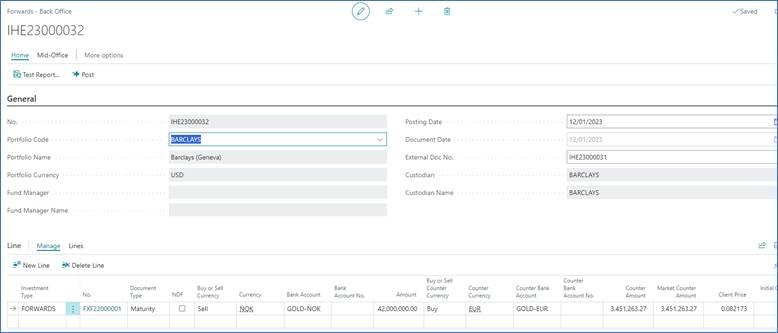

Fill in the contract line by selecting “Maturity” as a Document Type, the corresponding Investment Type, then double-click the “No.” field and select the Forward No. you want to mature (or use the function "Close Forward").

Contract generated by Close Forward function (to change the status to Completed).

Created contract.

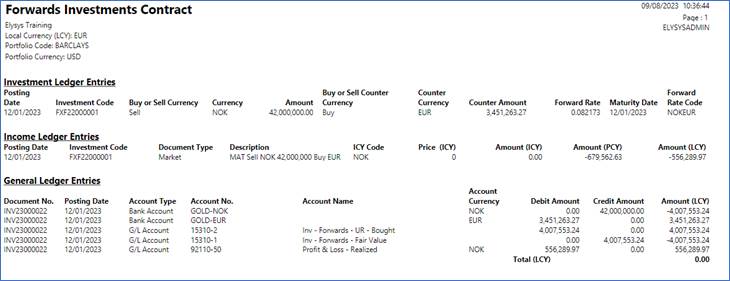

Preview of the maturity with NDF unticked

Preview of the maturity with NDF ticked

Navigate functions

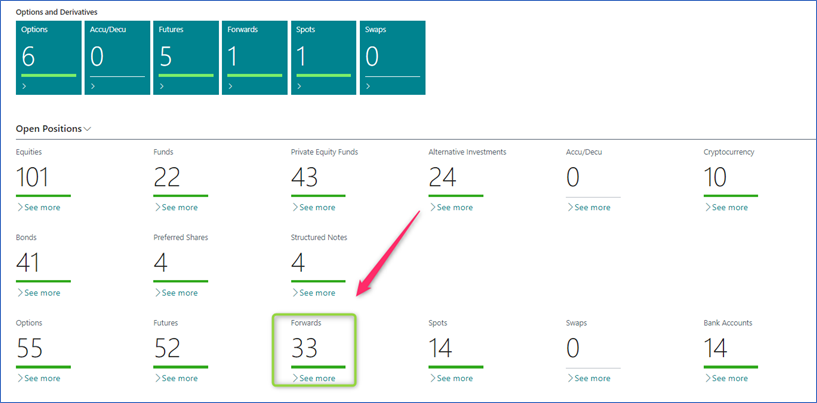

Detailed View (Open Position)

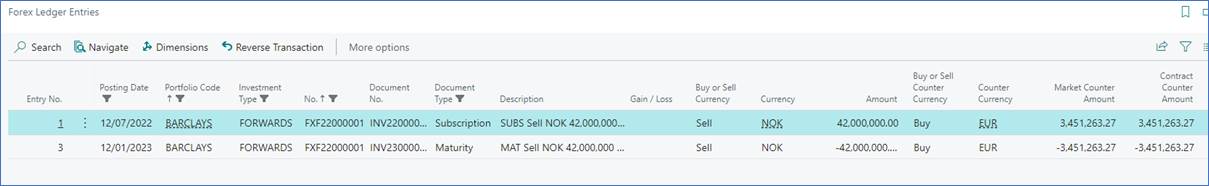

Forex Ledger Entries

Shows all the ledger entries for the relevant “Investment Code”.

Down below is the Subscription contract posted in the ledger and the maturity contract.

Dimensions

Link Dimensions to the investment card. These Dimensions will be linked to all ledger entries.