This document is accompanying the Elysys Wealth module, and it has been created for the purpose of providing users with brief guidance on how to process contracts for the dividend split, stock split and reverse stock split.

The system is enhanced by adding Dividend Split, Stock Split and Reverse Stock Split shares calculation.

The feature works with Equities, Funds, Alternative Investments and Cryptocurrency and it allows stock increase and decrease to the outstanding number of shares.

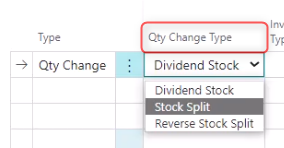

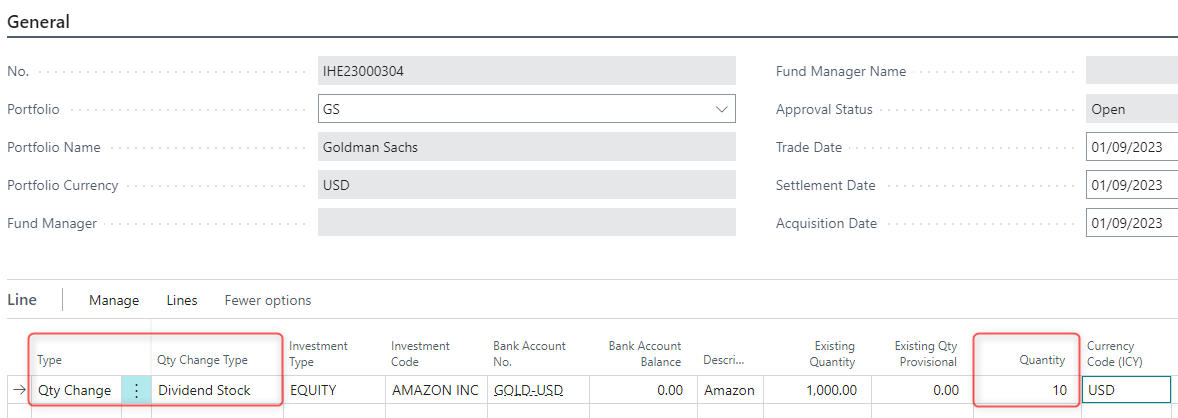

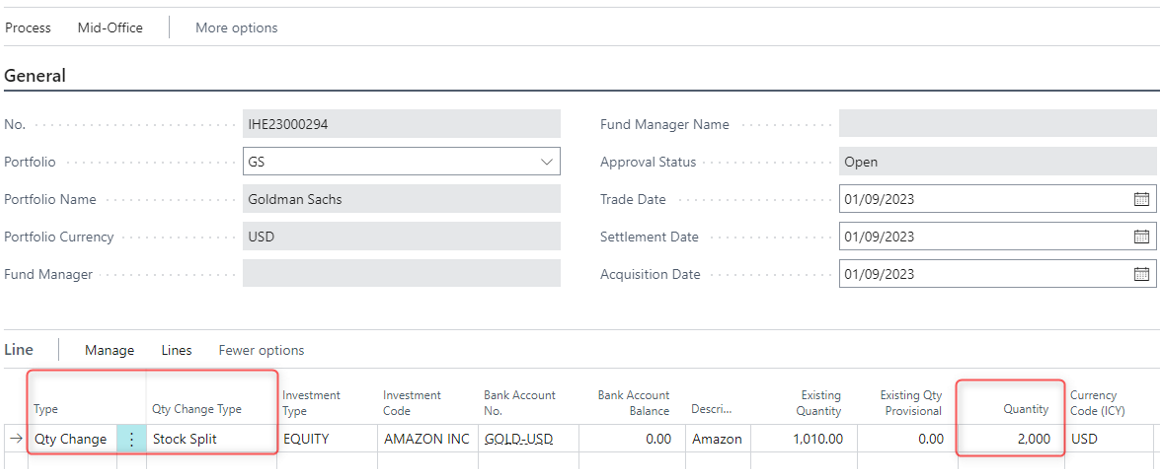

A new field Qty Change Type was added to the contract level. In combination with Type = Qty Change, the user can select from the three options below.

-

Dividend Stock - distribution of additional shares.

-

Stock Split - increases the number of outstanding shares. Stock Split allows only positive adjustment and is calculated by dividing existing shares into multiple shares.

-

Reverse Stock Split - decreases the number of outstanding shares and only negative adjustment is allowed.

(1) Dividend Stock Qty Change

Equities - Back Office

Report

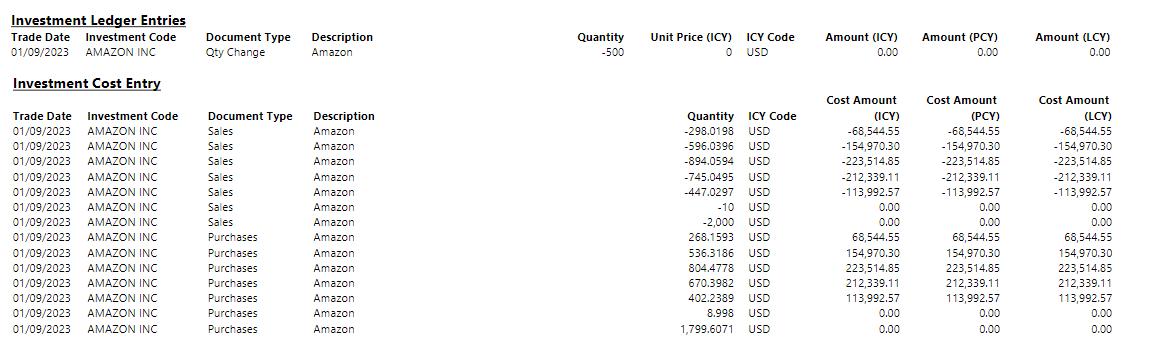

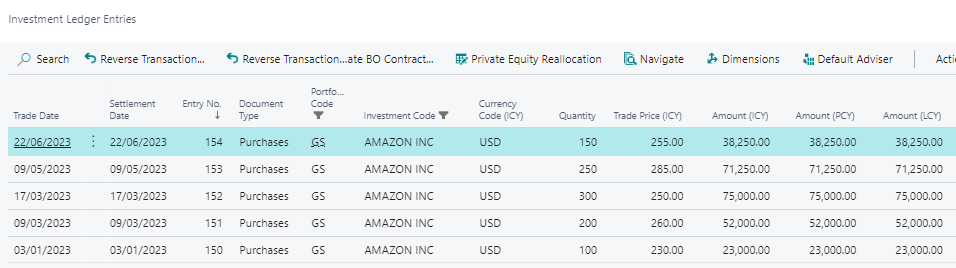

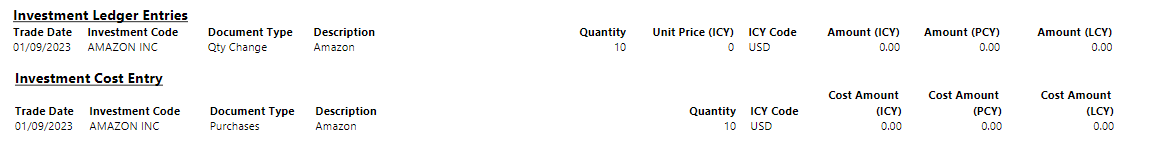

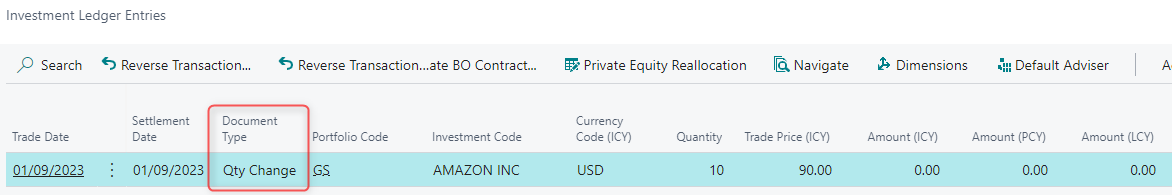

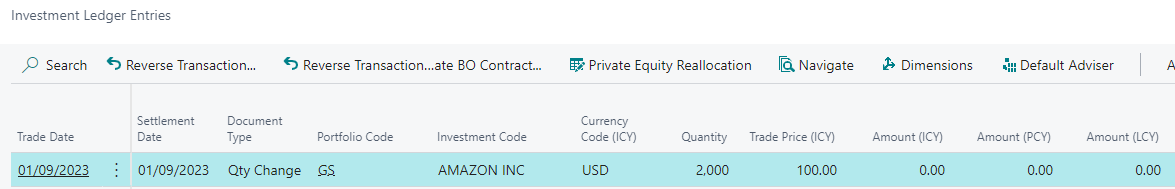

Investment Ledger Entries

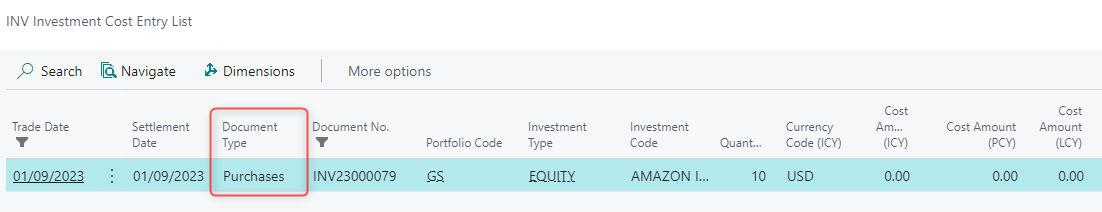

Investment Cost Entry

(2) Stock Split Qty Change

-

Automatic allocation to outstanding lot at trade date based on the following formula:

-

Quantity Lot 1/ ((Sum of all Purchases)/(Sum of all Purchases+ Qty Stock Split Change))

-

Stock Split allows positive adjustments only.

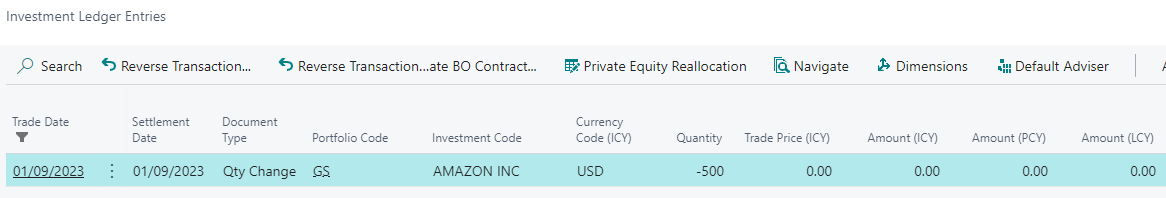

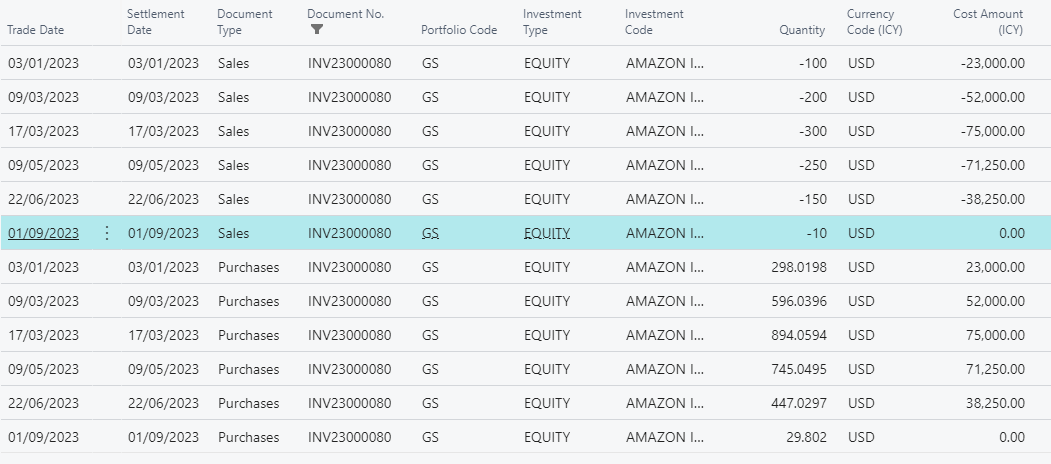

Equities - Back Office

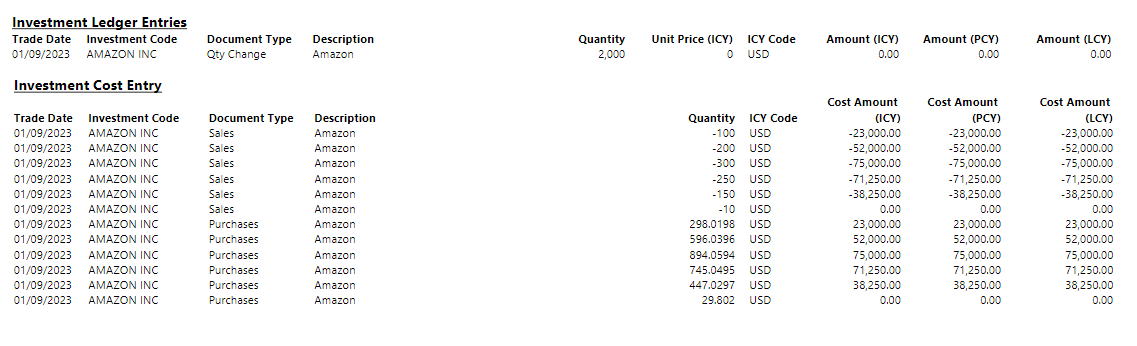

Report

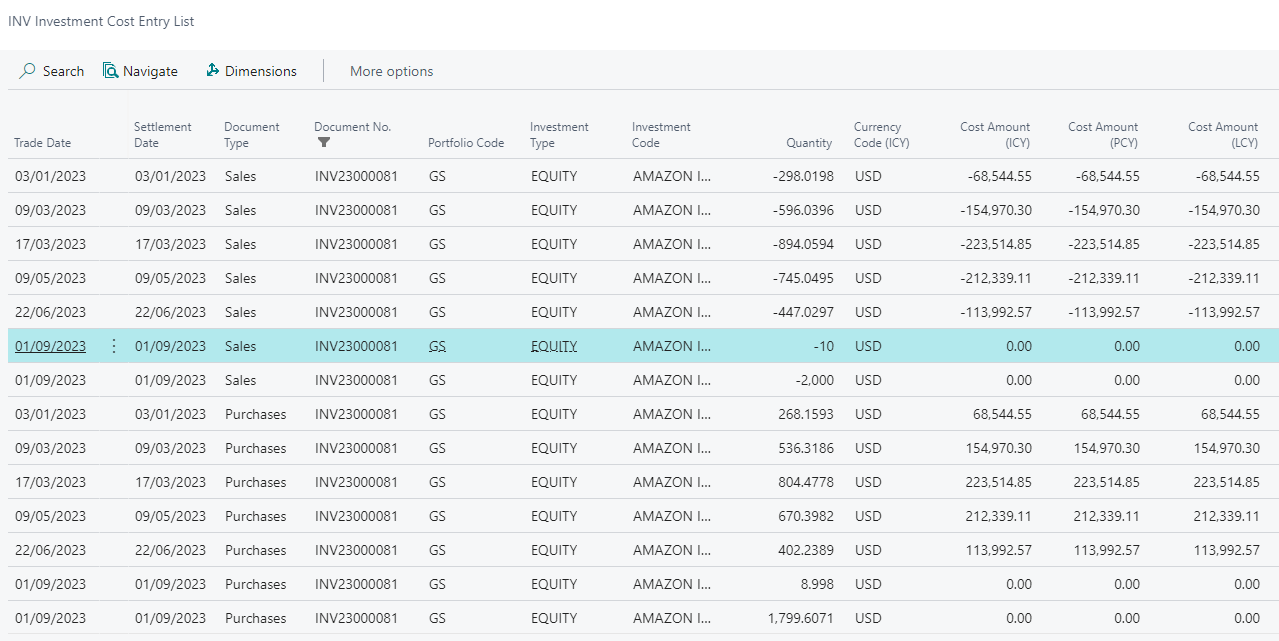

Initial lots are written off and Purchase lines are reopened with new Quantity.

Purchase = 298.01 USD is calculated as follows:

100/ ((1010)/(1010+2000)) = 298.01, where

100 = Qty (lot 1)

1000 = SUM (Qty (lot1): Qty (lot 6))

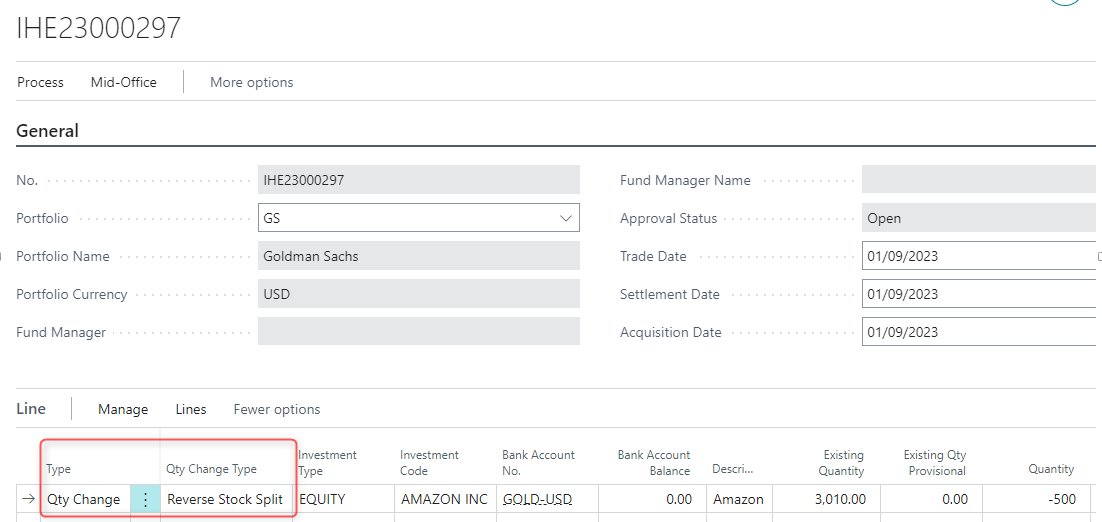

(3) Reverse Stock Split

Decreases the number of initial shares hence it needs to be booked in negative quantity.

Report

Initial lots are written off and Purchase lines are reopened with new Quantity.