Payment Journal

Scope

The Intercompany Payment Journal allows processing payments from another entity than the invoice was booked.

Notes

-

Intercompany Payment Journal can be processed from any company, regardless of the companies involved.

-

Intercompany Payment Journal triggers the creation of ledger entries and its reversals in both companies simultaneously.

-

Posted Transfer Journal is a historical aggregated view for all payments made across all entities.

-

For Intercompany transfers Interim Bank Accounts are created in source and target companies and linked to corresponding accounts in the Bank Account Posting Groups.

-

Intercompany Dimension allows tracking the source of transaction in the ledger entries in both entities.

-

Cashflow Classification specifies the cashflow category the transaction belongs to.

-

Transfer Instruction specifies details of the transfer of funds and its signatories in a pdf or a word document.

Workflow & Expected Results

IC A – Target Company

IC B – Paying Company

I. Intercompany Payments

a) Purchase Invoice

Purchase Invoice in amount of USD 1,000.00 is posted in Company IC A

b) Intracompany Payment Journal

Path: Elysys Wealth -> Toolkit -> Transfer -> Interco. Payment Journal

c) Suggest Payments

Intercompany Payment Journal -> Home -> Suggest

Suggest function allows filtering any outstanding payments across all companies and can be accessed from any company.

d) Intercompany Payment Suggest Screen

Interco. Journal Batch – multiple Journal Batches can be created for different users.

Payment Journal Batch – local journal batch linked to both paying and receiving company.

Paying Company – the company which will pay the invoice. If left blank, then the user can select Paying Company manually in the journal.

Suggest Date – date at which the system filters outstanding invoices to be paid. The system calculates it according to the payment terms defined for the vendor.

Summarize Per Vendor – if enabled the system suggests one line for all invoices belonging to the same vendor per company. If the vendor has invoices booked in multiple currencies, then the system suggests lines per currency.

Filter: Company – specifies the company we are suggesting the outstanding payments for. If the filter is disabled, then the system suggests outstanding invoices for all companies.

OK – validates the search

e) Suggested Payment

After the journal is suggested, the user needs to fill out the following fields:

-

Paying Bank Account – the main bank account the payment will be made from.

-

Paying Interco. Bank Account – Interim Bank Account of the Paying Company.

-

Target Interco. Account – Interim Account of the Target Company.

-

Cashflow Classification - specifies the cashflow category the transaction belongs to. The categories are user definable and are predefined in the Cashflow Classification Setup screen.

-

Signatory 1 & 2 – used for generating Payment Instructions. Signatory is the person that is approving the payment. Signatories are predefined in the following pages:

- INV Signatory List

- INV Signatory Card

-

Inter-Company Dimension – allows tracing the source of transaction in the ledger entries of both entities.

- Source Dimension -> specifies dimension value displayed in the ledger entries of the paying company; e.g., name of the target company.

- Target Dimension -> specifies dimension value displayed in the ledger entries of the target company; e.g., name of the paying company.

f) Transfer Instruction

Transfer Instruction can be accessed via the journal before posting. It is user definable and describes the details of the transfer.

g) Posting the Payment

Path: Intercompany Payment Journal -> Home -> Post

Posting the intercompany payment validates the payment in both entities simultaneously.

h) Posted Interco. Payments

Posted Interco. Payments take us to the aggregated/historical view for all intercompany payments posted across all entities.

Path: Intercompany Payment Journal -> Archive -> Posted Interco. Payments

Notes:

-

If the user selects Summarize Per Vendor in the Intercompany Payment Suggest screen, then Applies-to ID will generate a unique ID for this payment.

-

If the Summarize Per Vendor is disabled, then Applies-to Doc. Type and Applies-to Doc. No. are generated.

II. Ledger Entries

- Paying Company - IC B

DB Interim Bank Account 1,000.00

CR Main Bank Account 1,000.00

Cashflow Classification -> Interco Payment

Dimension -> IC A (Target Company)

- Target Company - IC A

DB Accounts Payable 1,000.00

DB Accounts Payable 1,000.00

CR Interim Bank Account 1,000.00

Cashflow Classification -> Interco Payment

Dimension -> IC B (Paying Company)

Reversal

Reversal can be processed from any company involved and reversal in one entity triggers the creation of ledger entries and reversals in both companies simultaneously.

III. Automation of Intercompany Dimension

The set-up allows dimensions to be automatically displayed in the Cash Transfer and Intercompany Payment Journals.

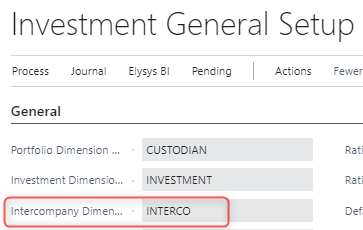

Investment General Setup

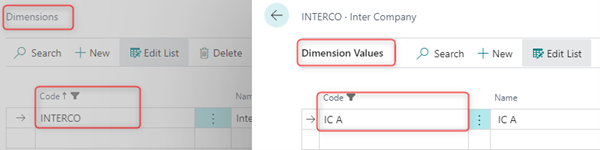

Under General Fast Tab, the Intercompany Dimension is set up with INTERCO.

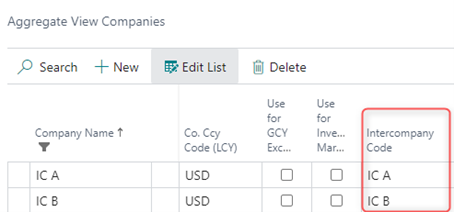

Aggregate View Companies & Intercompany Code definition

Here we assign the Intercompany Code that will be automatically populated for each entity involved in the ledgers. We can have one Intercompany Code per entity.

It is a reference code that is used for consolidation purposes and helps with tracking the source, e.g., the names of the companies from and into which the transfers are made.

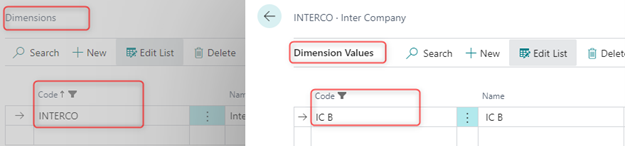

Dimension Value

Intercompany Codes are later selected as Dimension Values under Dimension Interco for each company involved in the transfer or intercompany payment.

Dimension Values are user definable, but they are usually set to match the names of the Source and Target companies.

Source Company – IC A is set with Dimension Value IC B

Target Company – IC B is set with Dimension Value IC A