Investment Transfer Journal

Scope

Intercompany Investment Transfer allows transferring an asset between two different entities at market price.

Intracompany Investment Transfer allows transferring an asset from one portfolio to another within the same company at average cost.

Notes

-

Asset Classes included: Bonds, Preferred Shares, Structured Notes, Equities, Funds, and Alternative Investments.

-

Investment Transfer can be processed from any company, regardless of the companies involved.

-

Posted Transfers is a historical aggregated view for all investment transfers made across all entities.

-

For Intercompany transfers Interim Accounts are created in source and target companies and linked to corresponding accounts in the Bank Account Posting Groups.

-

Intercompany transfers and their reversals trigger the creation of ledger entries and reversals in both companies simultaneously.

-

Intracompany transfers and their reversals trigger the creation of ledger entries and reversals in both portfolios simultaneously.

-

Cashflow Classification specifies the cashflow category the transaction belongs to.

-

Inter-Company Dimension allows tracing the source of transaction in the ledger entries of both entities.

-

Transfer Instruction specifies details of the transfer of an asset and its signatories in a pdf or a word document.

Workflow

IC A – Source Company

IC B – Target Company

Intercompany Investment Transfer

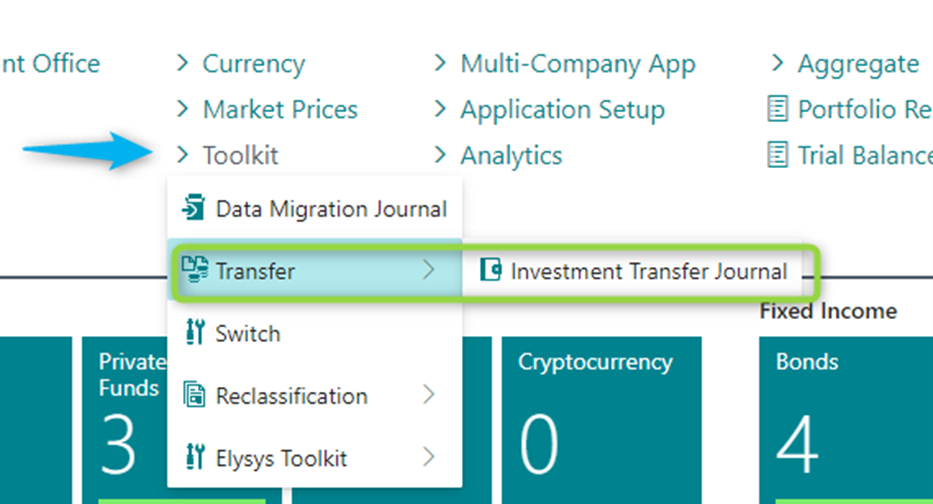

Path: Elysys Wealth -> Toolkit -> Transfer -> INV Transfer Journal

Notes:

Notes:

-

Source Company must be different from Target Company.

-

Source Company/Portfolio – the company/portfolio we are transferring the asset from.

-

Target Company – the company/portfolio to which we are transferring the asset to.

-

-

Transfer Type – specifies if the transfer is Cross-Company or Inter-Company transfer. The type auto populates by the system once the user selects the source and target companies.

-

Currency – the currency of the investment selected.

-

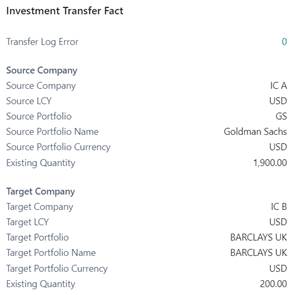

Existing Quantity – specifies the existing quantity of the selected asset.

-

Quantity – specifies the quantity/nominal to be transferred.

-

Unit Price ICY / (%) – for cross company transfers it is calculated at Market Price and it is user definable. For intracompany transfers it is calculated at an average price and cannot be amended.

-

Source/Target Bank Account – specifies main bank accounts the funds are transferred between.

-

Source/Target Balance Account – specifies interim accounts the entries will be booked against in the ledger entries in both source and target companies.

-

Payment Reference – specifies the reference of the payment.

-

Source Code – specifies where the entry was created. It auto populates based on the Source Code selected in the Intercompany Cash Journal Batch. If the Source Code in the batch is blank, then the user needs to select the Source Code in the journal manually.

-

Inter-Company Dimension – allows tracing the source of transaction in the ledger entries of both entities.

- Source Dimension - specifies the dimension value displayed in the ledger entries in the source company; e.g., name of the target company.

- Target Dimension - specifies dimension value displayed in the ledger entries in the target company; e.g., name of the source company.

a) Investment Transfer Details FactBox

a) Investment Transfer Details FactBox

FactBox displays the available quantity of the investment in source and target portfolios of the selected companies.

b) Processing Journal

Path: INV Transfer Journal -> Home -> Post

Posting the journal validates the transfer in both companies simultaneously.

c) Posted Transfers

Path: INV Transfer Journal -> Archive -> Posted Transfers

Posted Transfers take us to the aggregated/historical view for all investment transfers posted across all entities.

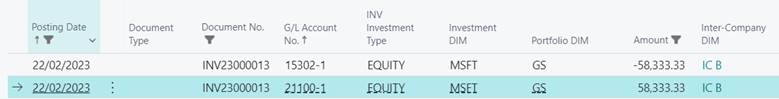

Ledger Entries

a) Source Company – IC A

DB Interim Account 58,333.33.00

CR Equity 58,333.33.00

Dimension -> IC B (Target Company)

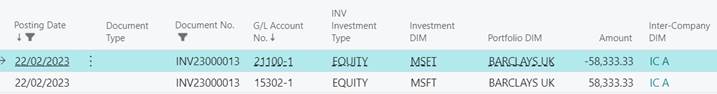

b) Target Company – IC B

DB Equity 58,333.33.00

CR Interim Bank Account 58,333.33.00

Dimension -> IC A (Source Company)

Intracompany Investment Transfer

Investment Transfer Journal for Specific Cost

The investment transfer journal allows now users to automatically transfer the position of an investment cross-company and intra-company, when the costing method is Specific Cost.

How to enable it

Access the Investment Transfer Journal

How it works – use case

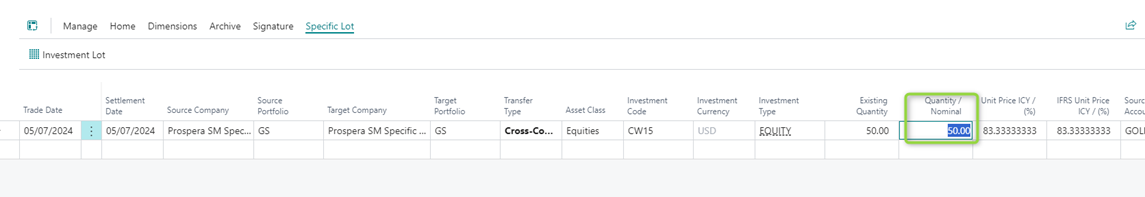

| Start by adding the transaction details, knowing that the user will process the journal a lot at a time |  |

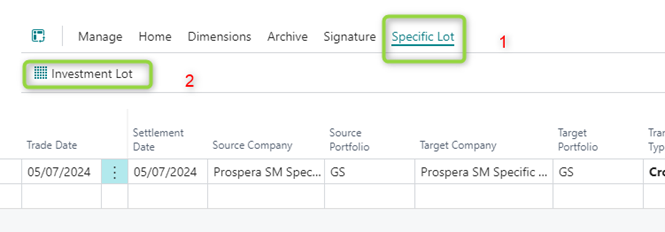

| Once the necessary fields are populated, user will access the Specific Cost ➔ Investment Lot function from the application ribbon |  |

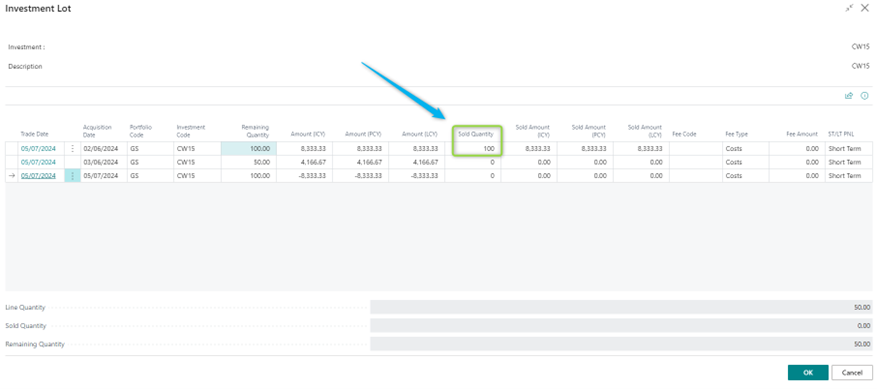

| The user will add the Sold Quantity for any lot to be transferred and says OK |  |

| The transferred lines will have the Transfer Type field populated in the Investment Ledger Entry |  |

After the transfer, each transferred lot will keep the same Acquisition Date as the initial lots

To transfer another lot, the user will repeat the steps above. You can not transfer all lots at once. For the cross-company transfer, it’s possible to do transfers only if the target company has the same costing method as the source company.

Ledger Entries

DB Target Portfolio 5,833.33.00

CR Source Portfolio 5,833.33.00

Reversal

Reversal can be processed from any company involved and reversal in one entity triggers the creation of ledger entries and reversals in both companies simultaneously.